working capital funding gap

Managing the working capital fund gap. Automation simplifies this a lot.

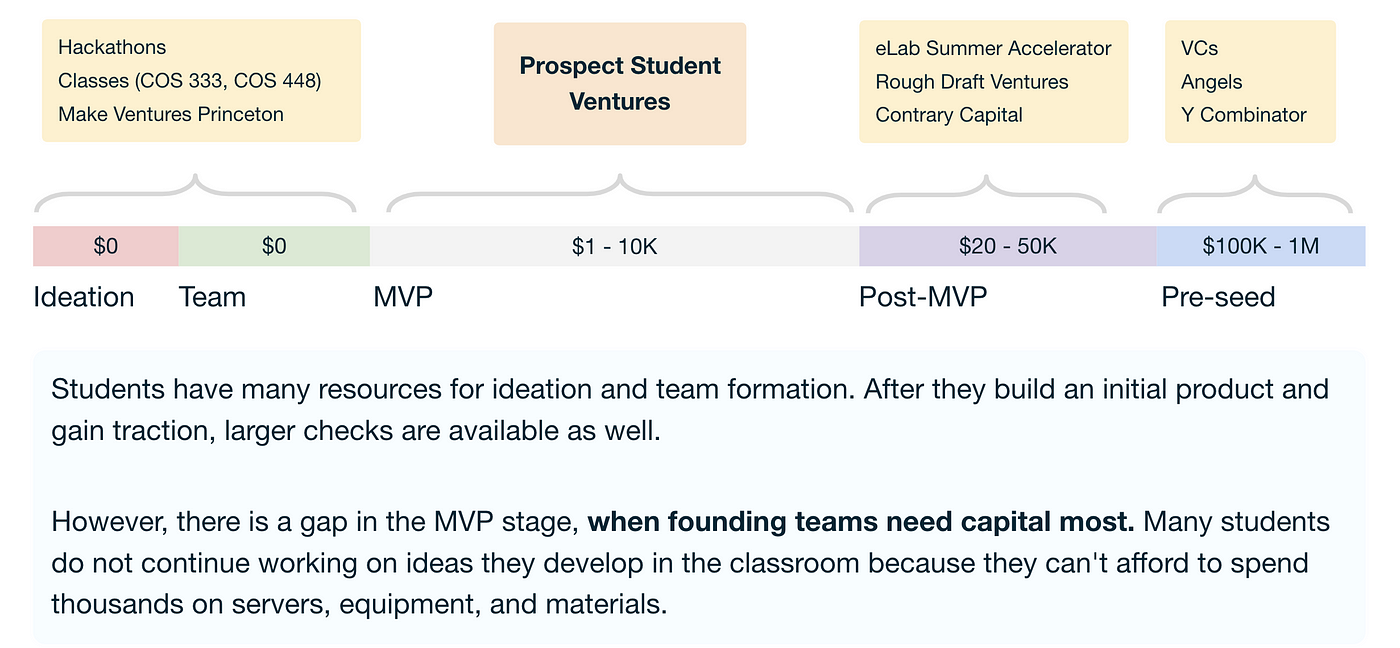

Introducing Prospect Student Ventures By Ayushi Sinha Prospect Student Ventures Medium

A funding gap is the difference between the money required to begin or continue operations and the money currently accessible.

. Raise the price of the products to increase. Prior to 2008 many small businesses applied for a loan from their bank and a good portion of them were successful. Working capital can be negative if current liabilities are greater than current assets.

A funding gap is the amount of money needed to fund the ongoing operations or future development of a business or project that is not currently funded with cash equity or debt. It can be used in. In the first part you learn how to get out of a short-term financing gap by increasing working capitalIn the second part you learn how to increase.

To get idle funds 1. When a business experiences a short-term gap in working capital they need cash now. What actions could a company take to reduce its working capital funding gap.

This is particularly prominent in supply chain funding. This is a two part series. Working capital is the cash used daily cover all of a corporations.

Work to match up the days outstanding for trade payables with the days outstanding for accounts receivable. Stockpile the inventory and make sure they are not out-of-stock. Gaining a few days.

Why the Working Capital Funding Gap Exists. One of the best advantages is that working capital financing is that you can receive. Give customers a discount if they pay.

Tighten customer credit terms. Working capital is calculated as. Working capital is the difference between a companys current assets and current liabilities.

The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas. Send invoices early so that you can get inflows faster. The proportion of the.

What actions could a company take to reduce its working capital funding gap. Funding gaps can be covered by investment from venture capitalor angel investors equity sales or through debt offerings and bank loans. The action Company should take to reduce its working capital funding gap by Increasing inventory levels.

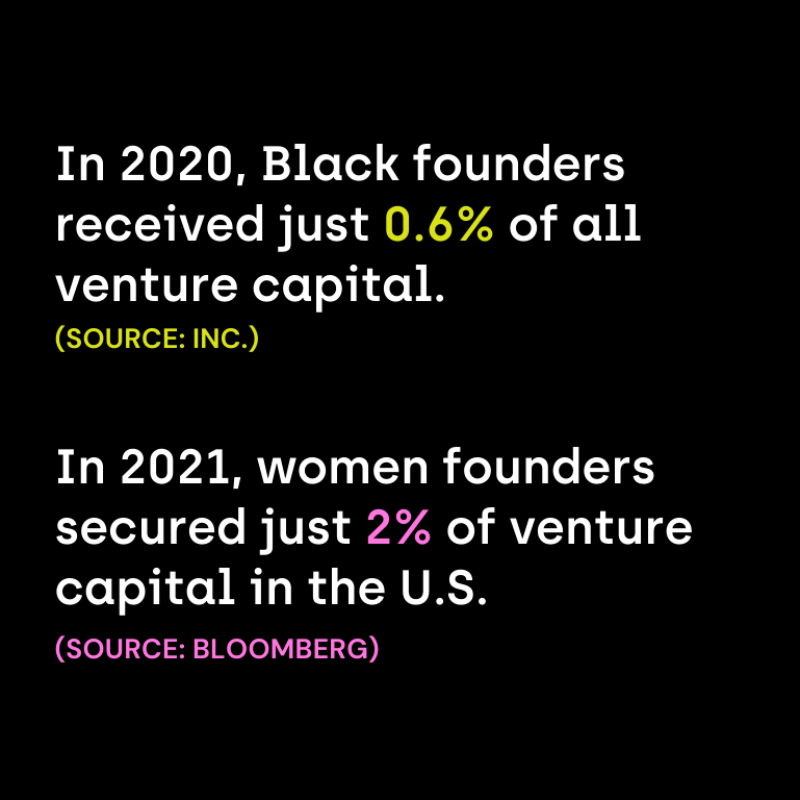

Building effective working relationships between corporates and banks. Funding gaps are common in very young. The debt to equity ratio indicates.

Working capital is a measure of both a companys efficiency and its short-term financial health. The keys to managing the cash flow gap are as follows. Days working capital is an accounting and finance term used to describe how many days it takes for a company to convert its working capital into revenue.

Insights Judo Bank Focused On Reducing The Sme Funding Gap

Net Working Capital Guide Examples And Impact On Cash Flow

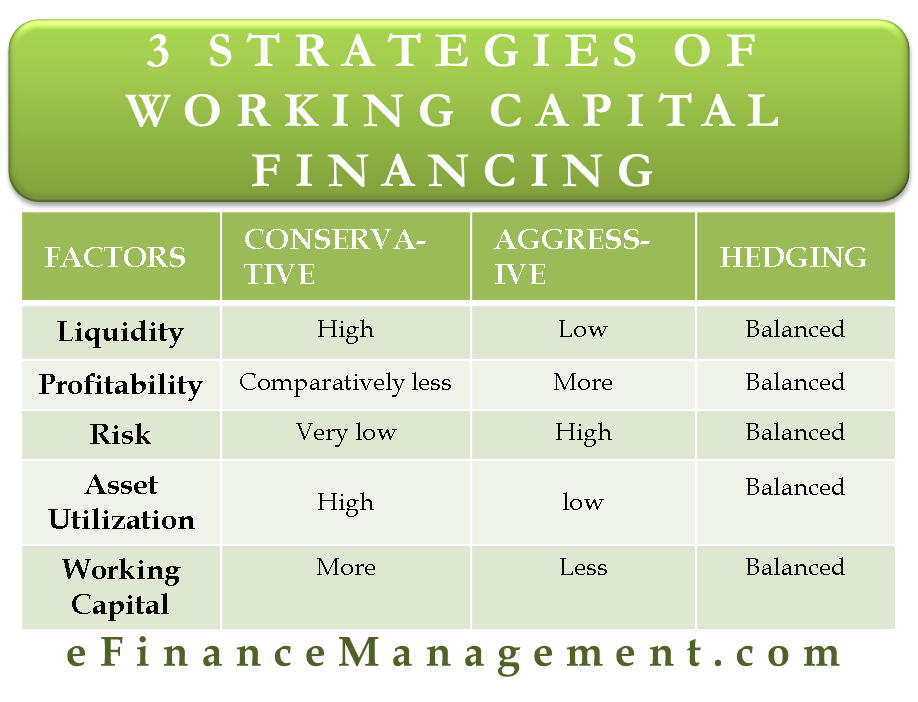

Compare 3 Strategies Of Working Capital Financing

Inventory Financing Commercial Business Funding

The Best Way To Understand The Working Capital Fund Gap Mycfong

Working Capital Financing What It Is And How To Get It

What Is Working Capital Gap Banking School

Funding The Cash Gap In Your Legal Practice Law Firm Finance

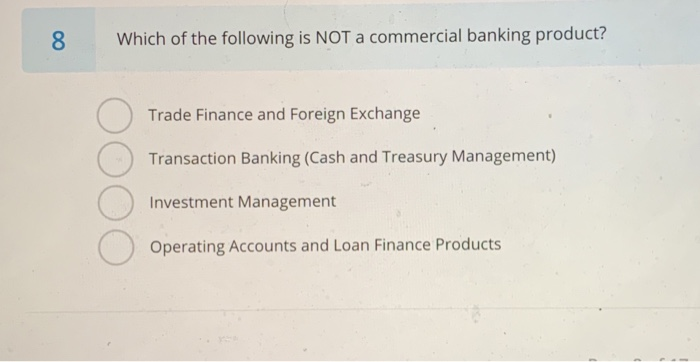

Solved 7 Which Products Are Used To Help A Business Manage Chegg Com

Working Capital Cycle Definition How To Calculate

Secret Tips To Improve Your Working Capital Management Quantzig

Settle Raises 15m From Kleiner Perkins To Give E Commerce Companies More Working Capital Techcrunch

Working Capital Cycle Understanding The Working Capital Cycle

/dotdash_Final_How_Do_You_Calculate_Working_Capital_Aug_2020-01-a35d03d74be84f8aa3ad4c26650142f6.jpg)

How Do You Calculate Working Capital

Acci Seeks Working Capital Gap Funding For Enterprises The Arunachal Times

Small Business Funding Resources Express Capital

Business Growth And The Inevitable Funding Gap

Treasury Essentials The Cash Conversion Cycle The Association Of Corporate Treasurers